In a watershed moment for the technology sector, Nvidia Corp (NVDA.O) became the first company to ever boast a $5 trillion market value, a feat that reflects the unbridled growth of artificial intelligence and the company’s leading role in powering the new era of electronics.

The milestone, reached on Wednesday, is a reflection of how Nvidia grew from a specialized graphics chip maker into the bedrock of the world’s AI revolution. What was once best known for its graphics processing units, or GPUs, for gaming, Nvidia is now a source of power for data centers, cloud computing, and generative AI systems driving the technology ecosystem today.

From Chipmaker to AI Powerhouse

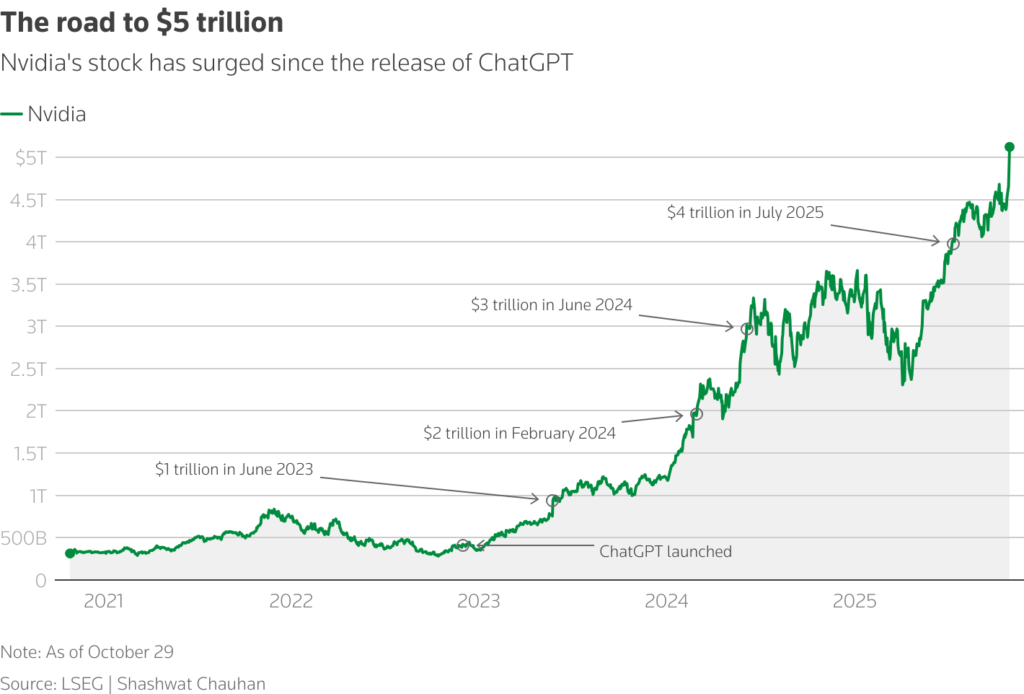

Under the visionary leadership of CEO Jensen Huang, Nvidia’s meteoric rise has redefined Silicon Valley’s innovation narrative. Since the debut of OpenAI’s ChatGPT in late 2022, Nvidia’s stock has surged more than twelvefold, fueled by insatiable demand for AI chips that power everything from chatbots to self-driving cars.

In the span of three months, the company’s valuation has risen from $4 trillion to $5 trillion, a increase that is larger than the total market capitalization of all cryptocurrencies and is roughly equivalent to half of Europe’s whole Stoxx 600 Index.

“Nvidia crossing $5 trillion in market cap is not a milestone; it’s a statement,” Hargreaves Lansdown senior equity analyst Matt Britzman said. “The company has evolved from being a chipmaker to becoming an industry builder, and shareholders still do not appreciate the size of this opportunity.”

Fueling the AI Economy

Shares of the Santa Clara, California company jumped 4.6% on a series of aggressive moves that claimed leadership in the battle to produce AI chips. Huang had recently announced plans for $500 billion in orders for AI chips and announced it was creating a joint venture with the U.S. government to build seven advanced supercomputers that would be employed to accelerate AI research and national computing capabilities.

Meanwhile, geopolitical drama surrounds Nvidia’s leading Blackwell chip, which remains the focal point of U.S.-China tech rivalry. Speculations are that former President Donald Trump will speak with Chinese President Xi Jinping regarding Nvidia’s export-restricted chips during an upcoming meeting as Washington maintains tight restrictions on China’s purchase of cutting-edge AI hardware.

Jensen Huang’s Fortune Booms

Nvidia’s incredible surge has also made Jensen Huang a billionaire on the list of world billionaires. Huang is currently the world’s eighth-wealthiest individual after his holding in the company was estimated to be worth approximately $179 billion, according to Forbes.

Huang, who was raised in the United States after being born in Taiwan, co-founded Nvidia in 1993 with an associate. Within three decades, his vision has watched the company’s H100 and Blackwell chips become the basis for modern AI infrastructure — powering such technologies as ChatGPT, Google Gemini, and Elon Musk’s xAI.

Industry-Wide Implications

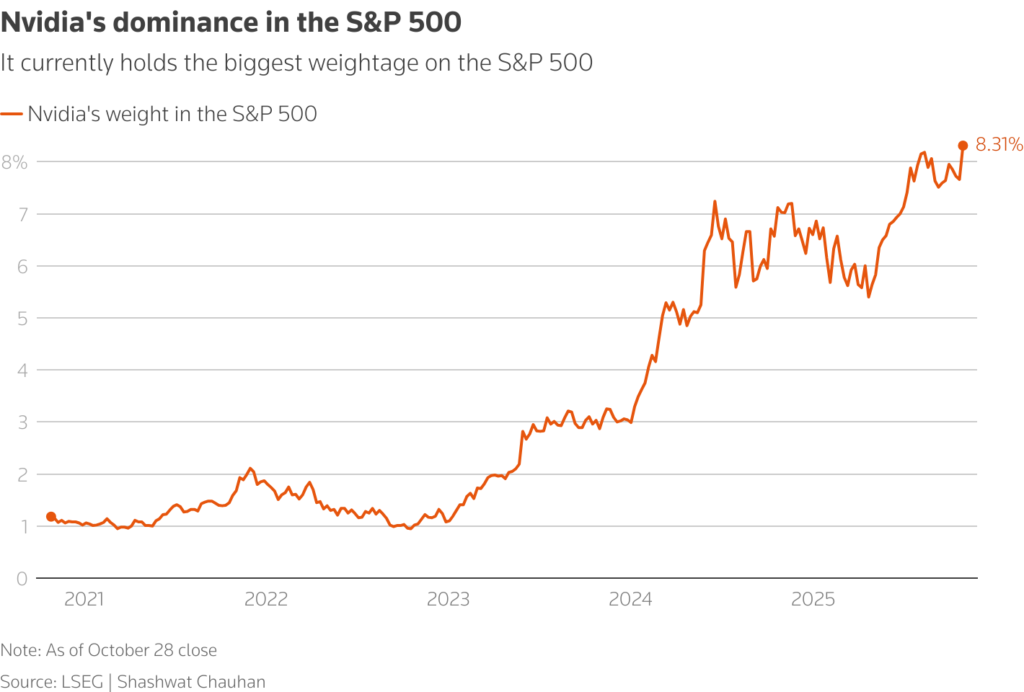

Nvidia’s ascent has also taken top tech benchmarks such as the S&P 500 and Nasdaq 100 to all-time highs, given the heavy weightage of tech giants in these indexes. The company now finds itself in the elite group of trillion-dollar giants such as Apple and Microsoft, both of which crossed the $4 trillion mark recently.

Yet some analysts say that the euphoria may ultimately find a stumbling block.

“AI expansion is dependent on a few market leaders investing in one another’s capacity,” warned Tuttle Capital Management CEO Matthew Tuttle. “If investors start demanding upfront cash-flow yield returns instead of capacity commitments, this trend will be reversed.”

Despite such fears, Nvidia is the undisputed leader in the market for AI hardware with an estimated 80% market share when it comes to premium AI chips. With AI adoption still in its initial stages in industries such as healthcare, automobile, and finance, experts believe that the company’s growth wave could run well into the next decade.

The Bottom Line

Nvidia’s $5 trillion milestone is more than a record-setting achievement — it’s a view of how quickly the age of AI is revolutionizing the world’s markets and technology agendas. As nations race to build AI infrastructure and as companies integrate generative AI into their business operations, Nvidia’s hardware remains the dominant driver accelerating the world’s next big technological breakthrough.

In short, Nvidia hasn’t just produced chips — it has produced the future of computing.